According to the World Bank’s Taking Stock report released in December 2016, despite a fragile global environment, Vietnam’s economy remains resilient thanks to robust domestic demand and export-oriented manufacturing. In 2016, the country’s GDP came in at 6.2%, and inflation rate stayed relatively low at 4.74% which is less than the annual 5% estimated by the government. Meanwhile, its medium-term outlook remains favorable with the World Bank and the Asian Development Bank forecasting a 6.3% GDP annual growth for Vietnam in 2017.

INDUSTRY SNAPSHOTS

71% look to strong growth in business

The majority (71%) of respondents in Vietnam project robust business performance for 2017, slightly down by 5 ppt compared to 76% in 2016. Similar to last year, about 65% of participants forecast their businesses to perform “slightly better” or “better than expected”. Yet 2017 may see an increase of about 8 ppt in the pool of “lower” and “worse than expected”.

INCREASINGLY ACCESSIBLE TO FDI

Vietnam has seen an upbeat growth in its foreign direct investment (FDI) over the past years as the country is increasingly attractive and accessible to FDI by diversifying its economic partners. For instance, although trade may become tougher due to Trump’s abolition of Trans-Pacific Partnership (TPP) trade pact, Vietnam has signed a free trade agreement with the European Union (EVFTA) last year to eliminate trade tariffs by 2018 and increased ASEAN integration through the Regional Comprehensive Economic Partnership (RCEP)

In 2016, Vietnam’s FDI inflows hit a record high of US$15.8 billion, suggesting a 9% growth from a year ago. Newly registered FDI from APEC members made up over 80% of the total registered in Vietnam. South Korea pledged the most funds last year, followed by Japan, Singapore, China and Taiwan. In terms of industries, the large majority of FDI flew into the manufacturing and processing sector, namely 63.7% of FDI (US$15.5 billion), further establishing Vietnam as a main manufacturing hub. The automobiles and motorbike wholesale (7.8%) and real estate sector (6.9%) followed suit.

TURNOVER

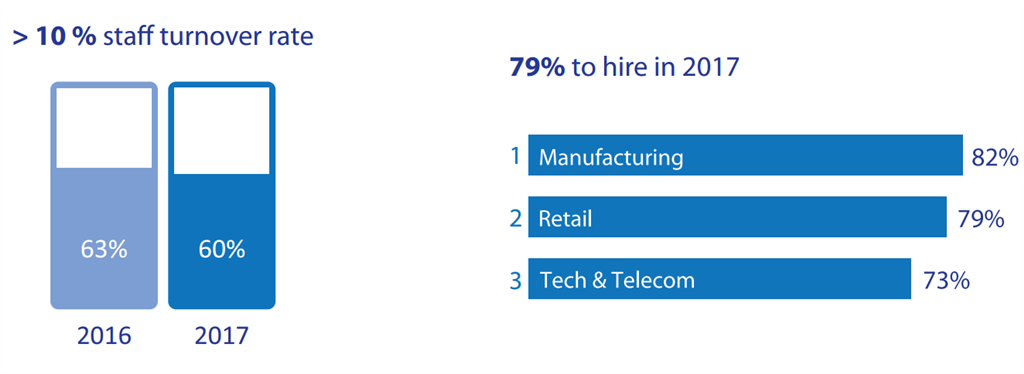

60% project a turnover rate at over 10%

Vietnam’s overall turnover rate this year is projected to resemble last year’s, as respondents in the category of “over 10%” make up 60% and 63% for 2017 and 2016 respectively. In addition, official statistics reported that Vietnam’s young people (aged 15 to 24) were accounted for 47% of the unemployed nationwide in the first six months of 2016 mainly due to a mismatch of supply and demand.

HIRING EXPECTATIONS

Manufacturing takes the lead in recruitment

Vietnam’s job market is anticipated to remain dynamic in 2017 thanks to the country’s political stability, a relatively low price level and young and hard-working population. Our survey reveals that 70% of respondents are expecting new recruits, half of which hire for company expansion. Analyzed by sector, Manufacturing (82%) again shows the strongest hiring expectations this year. Retail & FMCG (79%) and Tech & Telecom (73%) follow the lead.

SALARY TRENDS

7.3% wage hike across the country

As Vietnam’s National Wage Council announced in last August, employees nationwide will enjoy an increase at 7.3% for minimum wage in 2017. It is the highest increment compared to Vietnam’s neighbors in East Asia, believed to be “in response to competition from fellow manufacturing powerhouses in the region and hence primarily an effort to maintain its attractiveness to foreign investors and businesses”

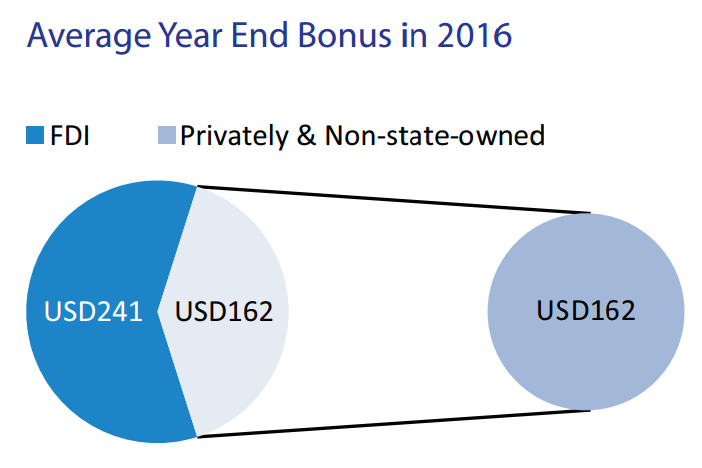

The average amount of year-end bonuses in 2016 varied in forms of business organizations. FDI enterprises were the most generous to have released an average of US$241, and private companies and non-state owned corporations together took the second spot (US$162)

Please take a look at the below link

http://www.farorecruitment.com/wp-content/uploads/2017/03/Report2017_1page.pdf for the full report