Personal income tax is an amount of money that an income earner has to deduct part of his salary or from other sources of income into the state budget. This tax is calculated based on various fees and legal requirements. Nowadays, in fact, not everyone has to pay personal income tax and not all individuals or businesses can have a deep understanding of income tax laws. Therefore, the advent of personal income tax declaration service helps individuals and organizations can accurately and effectively solve these tax issues.

Basically, the individual income tax service will be used by individuals and businesses in the following cases:

- Individuals must make personal tax declarations, prepare documents, information and forms according to the regulations of tax authorities but do not understand the tax administration law clearly. It is time for them to consider another effective method - the personal income tax service which gives instructions while individuals only have to follow to complete the application, quickly and easily, as well as follow the prescribed procedures.

- As a foreign-invested enterprise that does not have a lot of knowledge about Vietnam's policies and procedures, it should avoid risks related to tax obligations and the tax procedures when enterprises use the tax declaration service and personal settlement services.

- Vietnamese enterprises that do not have their own operating department or their main operating department are not able to handle all situations related to personal income tax. Therefore, the business will hire personal income tax service to avoid the scope and optimize the cost of time and opportunities for business.

- Individuals or businesses can make their own personal income tax reports but do not know whether they are correct or not so they need personal income tax services to consult and check tax reports.

Personal income tax service in Faro Vietnam

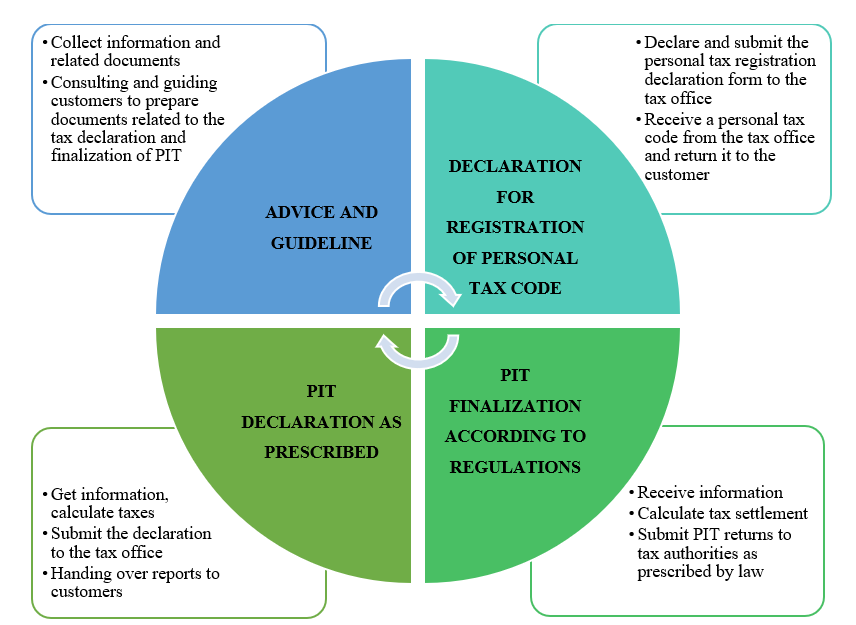

Faro Vietnam's Personal income tax service will consult and guide customers to prepare the necessary information and documents according to regulations. We will do the following:

Consultation and guideline

-Collecting information and related documents.

-Consulting and guiding customers to prepare documents related to the tax declaration and finalization of PIT

Declaration for Registration of Personal Tax Code

Declaring and submitting the personal tax registration declaration form to the tax office.

Receiving a personal tax code from the tax office and returning it to the customer.

Pit Declaration as prescribed

Getting information and calculating taxes

Submitting the declaration to the tax office

Handing over reports to customers

Pit Finalization according to regulations

Receiving information

Calculating tax settlement

Submitting PIT returns to tax authorities as prescribed by law

Benefits of using Faro Vietnam's personal income tax administration service

Faro Vietnam is proud to be one of the most professional and effective personal income tax service providers for businesses and individual taxpayers. With a team of consultants and trainees having professional knowledge and over 15-year experience, we are committed to effectively handling all requests of customers related to personal income tax under the correct conditions and provisions of current law.

When using Faro's personal income tax service, customers will get:

Updating Tax policy to businesses and individuals

Current tax regulations always adjust over time, so if businesses and individuals do not update regularly, it will be easy to miss information, which can lead to error, waste time and even fines. Faro's personal income tax consultants will support businesses and individuals by importing timely tax policy goods advice to create the best benefits to customers.

Limiting risks for businesses and individuals

As mentioned, individual income tax regulations constantly change in diverse business environments. Moreover, the process of treating personal income tax procedure is likely to have troublesome nuts and we must work directly with the tax department. This is a big problem for any businesses or individuals but it is very simple for the professional personal income tax service of Faro Vietnam. By knowledge and experience, Faro Vietnam ensures to deal with any arising situations to limit the risk of tax law scope and also co-occurs with tariffs. We will, on behalf of businesses and individuals, handle accounting and tax reporting issues effectively.

Minimising costs for businesses and individuals

For large enterprises, one or two main employees cannot fully guarantee personal income tax work for all employees. For small businesses, it is common for non-professional accountants to take this responsibility. As for taxpayers, time is money, while they themselves have to spend a huge amount of time and money to complete all procedures from A to Z. Therefore, using Faro Vietnam's personal income tax administration service, at a lower cost than hiring or recruiting qualified accountants, will save time, money and labour in completing the personal income tax finalization procedures. In addition, with its real-life experience, Faro Vietnam also finds the most comprehensive, correct and economic solution for businesses to minimize costs.

Contact Faro Vietnam

Using Faro's personal income tax consulting services will bring about many benefits to each individual and business. In addition, the range of personal income tax services that Faro provides is also very diverse sand supports all matters related to personal income tax so that customers can focus on their professional subject. Contact us today for advice and use of personal income tax services with the following information:

Email: service.vn@farorecruitment.com

HANOI HEAD OFFICE

Add: Unit 701A, 7th floor, Handi Resco Tower,521 Kim Ma street, Ba Dinh district, Ha Noi

Tel: + 84 24 3974 3091

Fax: + 84 24 3974 3090

HO CHI MINH CITY OFFICE

Add: 6th Floor, Saigon Finance Center Tower, 9 Dinh Tien Hoang Street, Dakao Ward, District 1, Ho Chi Minh City

Tel: + 84 28 3821 4654

Fax: + 84 28 3821 465