On 24 September 2021, the Government issues the Resolution No. 116/NQ-CP regarding policies on supporting the Employee and the Employer in difficulty due to Covid-19 by fund from the Unemployment Insurance (UI) Treasure. According to this Resolution, the Government decides:

1. Giving financial support with maximum rate of VND 3.3 million on per person to the Employee contributing UI

- Financial support is given to the following beneficiaries:

-

The Employee who have been contributing UI till 30 September 2021 (except those working for state agencies, political organizations, socio-political organizations, units of people’s armed forces and public service delivery units whose recurrent expenditures are financed by the state budget).

-

The Employee who stop contributing UI due to employment termination during the period from 01 January 2020 to 30 September 2021 and have UI contribution periods reserved (except those who are receiving monthly pension).

- Support amounts are set out based on the UI contribution period without claiming for unemployment allowance, specifically as follows:

-

Having UI contribution period of less than 12 months: 1,800,000 dong/person.

-

Having UI contribution period between 12 months and less than 60 months: 2,100,000 dong/person.

-

Having UI contribution period between 60 months and less than 84 months: 2,400,000 dong/person.

-

Having UI contribution period between 84 months and less than 108 months: 2,650,000 dong/person.

-

Having UI contribution period between 108 months and less than 132 months: 2,900,000 dong/person.

-

Having UI contribution period of 132 months and more than that: 3,300,000 dong/person.

- The schedule for giving financial support: from 01 October 2021 to 31 December 2021.

2. Cutting down the Employer’s UI contribution rate

-

The UI contribution rate of the Employer (except state agencies, political organizations, socio-political organizations, units of people’s armed forces and public service delivery units whose recurrent expenditures are financed by the state budget) is cut down from 1% to 0%.

-

The reduction takes effect from 01 October 2021 to 30 September 30, 2022

-

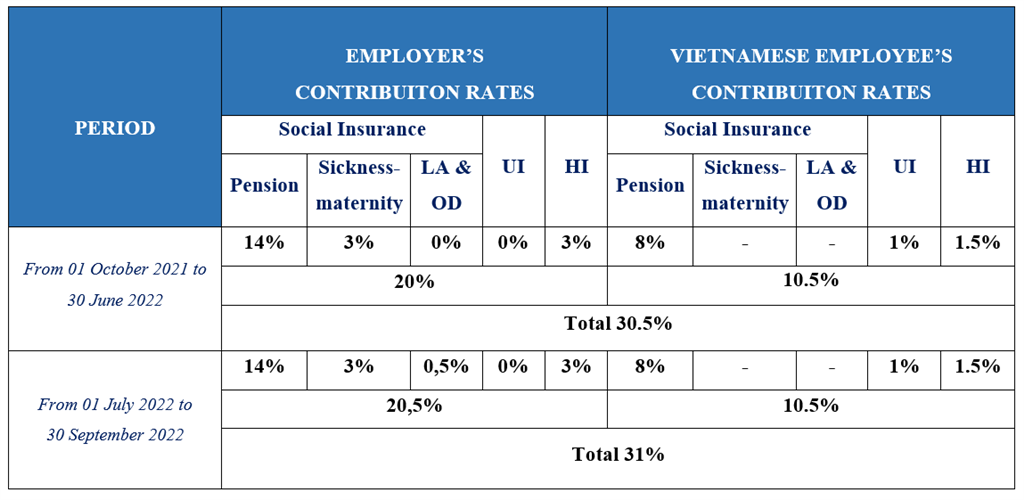

In summary, the rates of compulsory insurance contributions to the pension fund, sickness and maternity fund, occupational accident and occupational disease fund (LA & OD), unemployment insurance (UI), Health insurance (HI) of the Employee and the Employer (in the non-state sector) are as follows:

---------------------------------------------------------------------------------------------------------------------------------------

Please follow Faro Vietnam's website to be in the know with the latest regulations and decrees as soon as they are issued.

👉 Contact us for advice and support on related issues during the Covid-19 time

📨 service.vn@farorecruitment.com

☎ + 84 24 3974 3091 (Hanoi Office) / + 84 28 3821 4654 (Ho Chi Minh Office)

>> Click here to see the Vietnamese version of this news