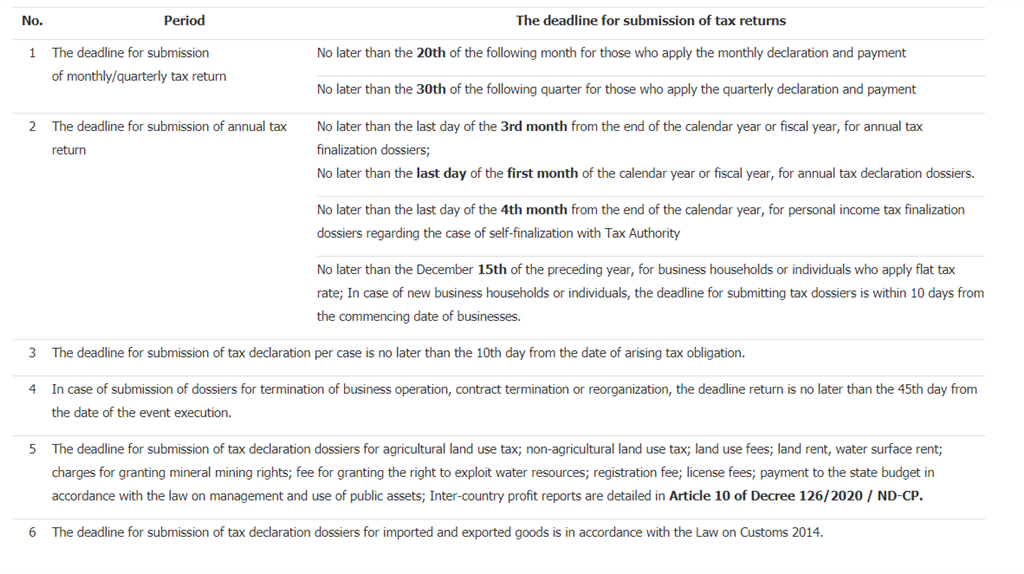

Pursuant to Article 44 of the Law on Tax Administration 2019, the deadline for tax return submission is regulated as below:

As you may be aware, the Vietnamese government issued Decree 125/2020/ND-CP (Decree 125) on October 19, 2020 listing several penalties and administrative fines for breaches in tax and invoicing regulations. The Decree has come into effect since December 5, 2020.

In accordance with the Decree 125, in case that the Company fails to meet the set deadline for submission of tax returns under Law on Tax Administration 2019, the Company shall be subject to tax recollection and tax penalty as well. The amount of fines depends on the number of days you are late to submit the declaration and/or payment, ranging between VND 2,000,000 and VND 25,000,000.