-

Applicable Object:

The Expat employee is subjected to SI contribution when he/she:

-

Obtains work permit, or practicing certificate, or practicing license granted by Vietnamese functional authority; and

-

Signs a labour contract with indefinite-term or definite-term of at least full 12 months with Vietnamese employer.

-

The Expat employee not subject to SI contribution:

-

The Expat employee is an intra-company transferee as stipulated in clause 1 Article 3 of the Government’s Decree No. 11/2016/ND-CP (the Expat employee is a manager, managing director, expert or technician of a foreign Enterprise which has a legally established commercial presence in Vietnam and is temporarily transferred to its commercial presence in Vietnam. The expat employee must work for the foreign enterprise for at least 12 months).

-

The Expat employee reaches retirement age as stipulated by Vietnamese Labour Law (Male: 60 years old, Female: 55 years old).

-

Contribution rates and salary base for SI contribution:

.png)

The monthly base salary for SI contribution includes salary, allowance and other subsidies as prescribed by the labor law. The monthly base salary for SI contribution is capped at 20 times of minimum common salary.

4. The expat employee signing labour contracts with several employers

For the Expat employee signs labour contracts with more than one employer and subject to SI contribution, the expat employee and the first employer shall only have to contribute SI under the first employment contract. Regarding labour accident and occupational disease insurance, the concerning employers are required to contribute for the insurance under each employment contract.

5. SI Benefits:

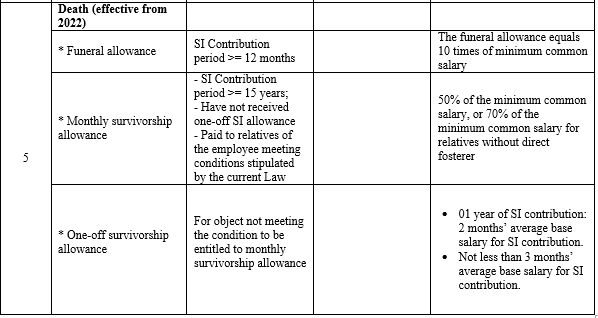

The expat employee who contributes compulsory SI shall be entitled to the below SI regimes:

.png)

.png)

6. Lump-sum SI allowance:

The expat employee is entitled to a lump-sum SI allowance upon his/her request when falling in one of the following cases:

-

He/she reaches the retirement age, but has not yet contributed SI for full 20 years;

-

He/she is suffering from one of the fatal diseases, such as cancer, polio, cirrhosis with ascites, labra, serious tuberculosis, HIV infection moved to the phase of AIDS disease and others regulated by the Ministry of Health;

-

He/she satisfies condition for pension entitlement, but not living in Vietnam anymore;

-

His/her employment contract is terminated, or his/her work permit, practicing certificate or practicing license expires without renewal.

7. Retention of the period of SI contribution:

If the expat has not met conditions for pension entitlement or has not received the lump-sum SI allowance after leaving work, his/her period of SI contribution shall be retained.

8. Expat employee receiving pension , SI allowance in Vietnam

If the expat employee who is receiving pensions, SI allowance is not residing in Vietnam anymore, he/she can authorize another person to receive these allowances or can apply for a lump-sum allowance.

9. Implementation:

This Decree shall be effective from December 1, 2018.